…as the popularity of electric vehicles in the United States is worsening

By Zheng Jun

Musk’s visit to China was fruitful

After his trip to China, Musk was in a good mood, perhaps the best day in the past year. Although he only stayed in China for 24 hours, Musk returned with a full load.

The biggest gain from Musk’s visit to China is far more than meeting with the Premier of the State Council of China. Tesla’s Shanghai Gigafactory cars have passed the Chinese government’s automotive data security certification, becoming the first foreign-funded company to obtain this certification. Therefore, various parts of China have gradually lifted the ban on Tesla’s suspension and travel, resolving Tesla’s biggest uncertainty in China and helping to further boost Tesla’s sales in China.

More importantly, Tesla’s Advanced Assisted Driving System (FSD) is finally expected to be approved in China and launch services for Tesla Chinese owners. After Musk’s visit to China, the FSD purchase page on Tesla’s China website has changed from “Launching Later” to “Coming Soon.”

For Tesla, FSD is a new revenue growth engine at a time when car sales are in decline. In order to stimulate more car owners to purchase FSD, Tesla just last month lowered the subscription price of FSD from US$199 to US$99 per month, and the one-time purchase price from US$12,000 to US$8,000 (it was still US$15,000 last fall).

If FSD finally lands in China, it will undoubtedly open up a new space for growth, and the capital market is also full of expectations for FSD’s growth prospects in China. Bank of America analysts released a report this week, predicting that Tesla’s FSD business alone will earn more than $2 billion in profits in China in 2030.

Bank of America analysts estimate this. Based on FSD’s current subscription price in the United States, Tesla has 1.6 million car owners in China. Even if only a quarter of users subscribe to FSD, it can bring in annual revenue of US$500 million. receive. FSD is Tesla’s highest-margin product, with a gross profit margin of over 70%, so this is equivalent to a net profit of US$350 million.

Bank of America analysts also believe that FSD can stimulate more Chinese consumers to buy Tesla and increase Tesla’s sales in China. If Tesla’s sales in China maintain its current growth momentum, FSD’s profits in the Chinese market can reach US$2.3 billion by 2030.

Americans are obviously optimistic about Tesla’s growth prospects in the Chinese market. According to the current exchange rate of US dollar to RMB 1:7.24, assuming that the price of Tesla FSD in China is on par with the United States, taking the monthly subscription price of 699 yuan as an example, how many Chinese car owners will pay for it is obviously a big question.

Whether you believe it or not, Wall Street does. After Musk’s visit to China, Tesla’s stock price swept away the previous sluggish trend. Last Monday, the stock price soared 15.4%, setting the largest single-day increase in three years. The market value rebounded by US$82 billion in one day.

Considering that Tesla shareholders will re-vote next month on Musk’s sky-high compensation worth more than US$50 billion, the recent rise in stock prices will help stabilize investor confidence and is crucial to Musk. It is no exaggeration to say that the trip to China provided Musk with a golden key to unlocking sky-high salaries.

Cut off the Supercharge team in the middle of the night

However, the first thing Musk did after returning to the United States was to continue layoffs. At 12:30 that night after returning to the United States, Tesla suddenly sent a company email announcing a new wave of layoffs. It should be said that this layoff is not surprising, but what is surprising is the target of Musk’s layoffs.

In the middle of last month, Tesla just announced 10% of its global layoffs. This was the fourth major layoff in Tesla’s history and the largest layoff, with more than 14,000 people losing their jobs. Also leaving were Tesla’s two directors of battery development and public affairs. Musk said this is to keep the company streamlined and innovative and enter the next growth cycle.

After this major layoff, the media once reported that Musk was not satisfied with the 10% layoff scale. He also wanted to cut more employees and save more capital expenditures. Musk even said that if any department retains more than three employees who have not received excellent performance appraisals, the department manager should resign.

Sure enough, after returning from China, Musk started new layoff measures non-stop. Compared with the major layoffs in the middle of last month, Tesla’s layoffs last week were not large, with only 500 people. What really shocked the outside world was that Musk actually fired the entire Supercharger team and new product development department.

The heads of the two departments, Rebecca Tinucci and Daniel Ho, also left. These executives have all worked at Tesla for many years. DiNucci is responsible for the infrastructure of Tesla’s Supercharging business, while Daniel Ho was a senior project manager for Model 3 and Model Y.

Tesla sent the layoff email at 12:30 a.m. on Tuesday. The email read, “As part of our cost-saving and headcount reduction plan, your position has been unfortunately eliminated.” Lane Chaplin, an engineer on Tesla’s supercharging team, complained online that he suddenly got sick in the middle of the night. As you know, the entire Supercharge team no longer exists. Most employees wake up in the morning and find that they are unemployed.

Musk’s explanation for the layoffs was, “We need to be extremely hard-core in terms of employee size and cost reduction.” Indeed, Musk has never been merciful when it comes to large-scale layoffs. In the first half of 2022, when Tesla was still growing, he laid off 10% of its employees globally. After completing the $44 billion acquisition of Twitter at the end of that year, Musk cut Twitter’s total number of employees from 7,500 to less than 1,800 within two months.

Charging standards have just been unified

However, the market’s biggest question about Tesla’s layoffs is: if it cuts off the entire Supercharging team, will it still be able to do Supercharging business? Musk later said on the X platform that the supercharging business will continue to expand, but it will be promoted at a slower pace and will focus on achieving full operation in the current region.

The day after the layoffs were announced, Tesla’s stock price fell 6%, returning to the price before the opening of last Monday, with the market value shrinking to US$577 billion. Tesla’s stock price has fallen by 27% this year, making it the worst-performing component of the S&P 500 Index. The S&P 500 index rose 8.1% during the same period.

However, Tesla will not build any more Supercharging stations at least for now, because the people who do these things have been fired by Musk. In the past year, although vehicle sales have faced many challenges and have had to continue to cut prices to stimulate sales, the super charging business has been one of the few bright spots for Tesla.

There is no doubt that the Supercharging network is a major advantage for Tesla in attracting electric vehicle consumers. In densely populated urban areas and along highways in the United States, Tesla has built relatively complete supercharging stations to meet the travel needs of Tesla owners. No other electric car company can do this.

Moreover, Tesla has also unified the charging standards for electric vehicles in the United States. In the past year, all major car companies, from Mercedes-Benz Volkswagen to Ford General Motors to Honda and Kia, as well as Rivian and Polestar, have announced that they will abandon the CCS charging standard and join Tesla’s NACS charging standard camp. The new models of these car companies will directly use Tesla charging sockets while existing cars can use Tesla’s Superchargers through adapters.

This is a big plus for Tesla. Unified charging standards mean that Tesla’s supercharging network can be opened to other electric car owners, greatly improving the utilization efficiency of existing supercharging stations and adding new revenue sources. Tesla opened its Supercharging service in the United States last year. Non-Tesla owners can either pay according to the amount of energy they use or subscribe to a monthly charging package of $13 and enjoy preferential electricity prices.

Goldman Sachs predicted last year that based on Tesla’s current charging network layout, Tesla’s charging service alone can increase revenue by US$1 billion per year; when Tesla’s supercharging piles reach 500,000 – opening supercharging piles to the outside world can bring in an additional $25 billion in revenue.

Limited revenue and profit contribution

Now that the U.S. charging standard has been unified and it can also bring charging revenue from other brands of electric vehicles, why did Musk ruthlessly cut off the Super Charging team?

According to KC Boyce, vice president of the electric vehicle industry organization Escalent, Musk cut off the supercharging business in order to save costs and invest in the autonomous driving business. While in China, Musk said that Tesla will invest nearly $10 billion in training and reasoning AI this year, especially AI technology related to driverless driving. The supercharging business has become a victim of Musk’s cost savings.

READ ALSO: African elections under rising threat from online disinformation

BNEF energy analyst Peter Ramsay believes that it is understandable for Musk to cut off the supercharging business because this business has very limited contribution to Tesla’s financial report. Tesla’s “services and other businesses” gross profit in its first-quarter financial report fell 40% to only $81 million, almost all of which came from the sale of used cars and parts.

Last year, the supercharging business only brought Tesla $1.74 billion in revenue, accounting for only 1.5% of Tesla’s total revenue. Therefore, when Musk needs to significantly cut expenditures and concentrate resources on AI research and development, the supercharger business becomes the target of his layoffs.

Musk cut off the supercharging business in order to save capital expenditure and focus on investing in the research and development of AI and driverless technology. However, this decision may have a significant negative impact on the U.S. government’s electric vehicle popularization plan and will also intensify the challenge of cooling demand for electric vehicles in the United States.

Because, as various car companies switch to Tesla charging standards, Tesla’s original charging standard NACS has become the unofficial national standard in the United States, even overwhelming the CCS charging standard promoted by the Biden administration. (Due to regulatory requirements, Tesla uses local CSS standards in Europe.)

The Biden administration’s relationship with Musk is notoriously frosty. For reasons of votes, the Biden administration has a very close relationship with Detroit car companies and is committed to promoting the electrification transformation of these traditional car companies. It is even unwilling to invite Tesla to electric vehicle industry conferences. Musk is therefore full of resentment towards Biden. He has ridiculed Biden’s political achievements in public on many occasions and said that he would never vote for the Democratic Party again.

The United States lacks charging infrastructure

Why don’t various car companies give a face to the Biden administration and join Tesla’s charging standards? Tesla is not only the largest-selling electric car company in the United States but also has the largest charging network in the United States. Tesla has more than 2,200 supercharging stations and 12,000 charging piles in the United States. There are only 183,000 public charging piles in the entire United States. More importantly, nearly two-thirds of the fast charging piles in the United States are owned by Tesla.

In comparison, the total number of public charging piles in China was 2.826 million in February this year, and an average of 80,000 new public charging piles were added every month over the past year (data from China Charging Alliance). In other words, the number of public charging piles in the United States is only 6% of that in China, which is equivalent to China’s new increase in two months.

The lack of charging facilities is one of the biggest obstacles to the popularity of electric vehicles in the United States. Last year’s electric vehicle popularity survey conducted by the Associated Press and the University of Chicago showed that up to 80% of respondents said that range anxiety caused by the lack of public charging networks in the United States was the main reason that prevented them from purchasing electric vehicles, and 70% of respondents said Respondents said they did not buy electric vehicles because the charging speed was too slow.

Last year, the sales of electric vehicles in the United States reached a new high of 1.19 million units, but the penetration rate in the United States was only 7.6%, and sales growth has slowed down significantly, with the growth rate being surpassed by hybrid vehicles. It is expected that the penetration rate of electric vehicles in the United States will reach 10% this year, which is significantly lower than the 14% of hybrid vehicles. Obviously, you don’t need to worry about mileage when buying a hybrid car.

The Biden administration proposed an ambitious plan as early as when it took office in 2021, proposing a five-year, $7.5 billion National Charging Infrastructure Initiative (NEVI), hoping to build 500,000 charging stations in the United States by 2030. , to achieve a charging station every 80 kilometres to encourage more Americans to buy electric vehicles and achieve the goal of new energy vehicles accounting for more than half of sales. Currently, 70% of charging piles in the United States have been installed in the past three years. This is also the main achievement of the Biden administration’s promotion of electric vehicles.

Just in January this year, the Biden administration provided another US$623 million in government funding and planned to build 47 charging stations in 22 states, adding a total of 7,500 charging piles. But the reality may be more difficult than the U.S. government imagines. The U.S. Department of Energy’s National Renewable Energy Laboratory estimated last year that the U.S. would need to build 1.2 million charging piles by 2030 to achieve more than half of electric vehicle sales under the Biden administration. The goal. This charging network density clearly exceeds the Biden administration’s expectations.

Tram demand continues to cool

Now that Tesla has given up on building supercharging stations, what impact will it have on the US government’s charging network construction plan? Many people in the industry are worried about this because Tesla is the main partner in the construction of the White House charging network. Tesla has received the largest amount of funding from the U.S. government for the construction of charging stations.

Will Jameson, an engineer on Tesla’s Supercharger team who was laid off, said on the X platform (formerly Twitter) that Musk fired the entire Supercharger team. He doesn’t know what impact this will have on Tesla’s charging network NACS and the previous charging network construction. “If Tesla hands over its charging business crown, who can take over?”

Loren McDonald, head of EVAdoption, the American Electric Vehicle Industry Association, said that Tesla’s supercharging network is at another level. If Tesla decides to slow down (new supercharging stations), then other Charging network companies will take over some of these projects (federal government funding), but not all.

People in the electric vehicle industry are also worried that this will exacerbate the cooling demand for electric vehicles in the United States. According to KC Boyce, vice president of Escalent, an electric vehicle industry organization, “Tesla’s cutting off the supercharging team will definitely delay the access to the US charging network and the pace of charging infrastructure deployment. This will definitely delay the growth of electric vehicle sales, whether by Tesla or non-Tesla car companies.

Although Tesla’s delivery fell by 8.5% in the first quarter of this year, Musk believes that Tesla will achieve growth again by the end of this year. But at least in the United States, Tesla and other car companies are facing the challenge of significantly cooling demand for electric vehicles, and his decision to cut off the charging team will only exacerbate this dilemma.

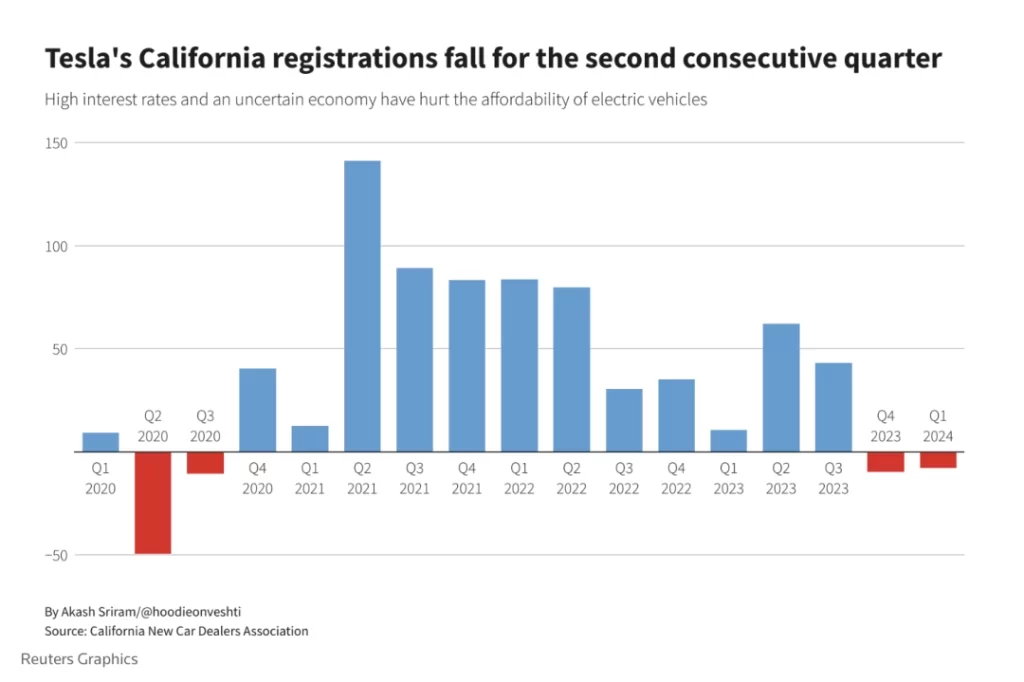

Take California as an example. California is the largest electric vehicle market in the United States and Tesla’s largest market in the United States. However, Tesla’s sales in California have declined for two consecutive quarters. In the first quarter of this year, Tesla’s new car registrations in California were only 50,000, a year-on-year decline of 8%, and a 9.8% decline in the fourth quarter of last year. Tesla’s hot new pickup truck, the Cybertruck, had 574 units registered in the quarter.

On the one hand, demand for electric vehicles in California has cooled, and on the other hand, Tesla’s sales have declined. In the first quarter of this year, the market penetration rate of electric vehicles in California fell to 20.9% from 21.2% in the same period last year. Tesla’s share of the California electric vehicle market fell by 6.4 percentage points to 55.4%.

The California New Car Dealers Association, which compiles the data, said Californians’ enthusiasm for Tesla may have peaked. Tesla’s market dominance is declining, and consumers are turning to traditional car companies.

Yes, the top-selling models in California in the first quarter of this year were Toyota Camry and Honda Civic, and Tesla Model 3 has slipped to third place. While Tesla’s sales are declining, Toyota and Honda’s new car registrations in California have increased by 9.3% and 18.6%.