Tether Releases Q1 2024 Attestation: Reports Record-Breaking $4.52 Billion Profit, Highest Treasury Bill Ownership Percentage Ever, Total Group Equity of $11.37 Billion

Today, 1st May 2024, Tether Holdings Limited (BVI) released its assurance opinion for the first quarter of 2024, conducted by BDO, a leading global independent accounting firm. The most recent attestation as of 31 March 2024, discloses additional financial information of Tether Group which is no longer limited to the reserves backing Tether Fiat-denominated stablecoins. The new report provides an overview of the entire Group’s financial strengths complementing the information provided in the former Reserve report which has become a section of this new enlarged and more transparent report.

Building on the momentum from Q4 2023, the first quarter of 2024 marked a significant milestone for the group with a record net profit of $4.52 billion.

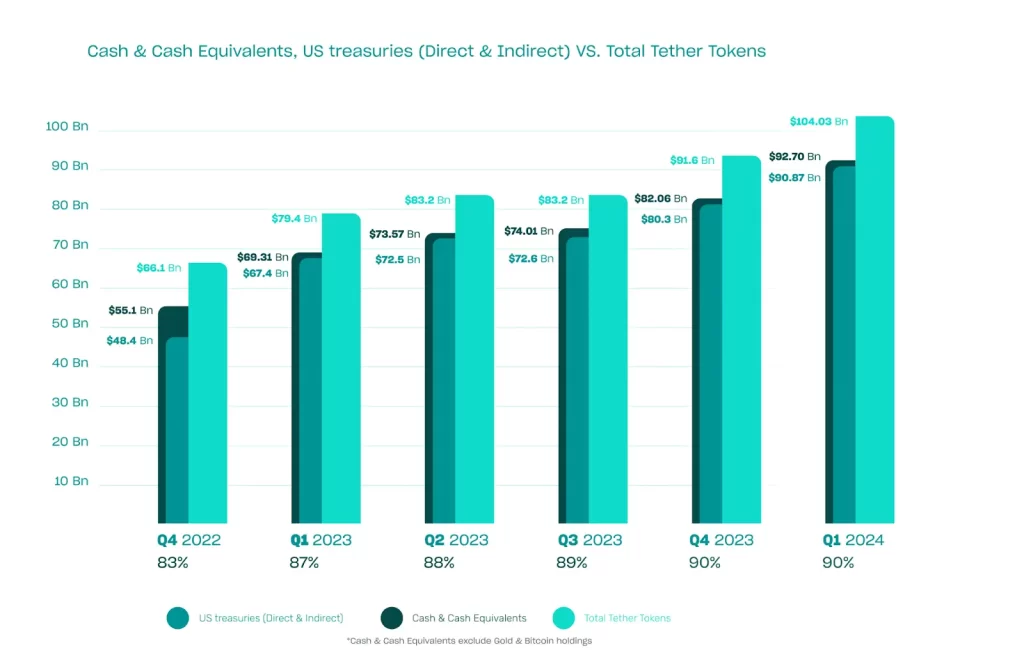

The main contributing entities are those in charge of issuing Stablecoins and managing the respective reserves where approximately $1 billion of this profit stemmed from net operating profits, primarily derived from US Treasury holdings. The remainder of the reported profits were comprised of mark-to-market gains in Bitcoin and Gold positions. Additionally, Q1 2024 showcased the Group’s unprecedented achievement in increasing both direct and indirect ownership of U.S. Treasuries, now in excess of $90 billion. Indirect exposure was calculated to include overnight reverse-repurchase agreements collateralised by US Treasuries, as well as investments in US Treasuries through money market funds.

Furthermore, as part of its steadfast dedication to transparency, the Group unveiled its net equity for the first time, revealing an impressive $11.37 billion as of March 31, 2024. This reflects a notable uptick from the recorded equity of $7.01 billion on December 31, 2023. The report highlights a $1 billion increase in excess reserves maintained as a buffer to support the Company’s stablecoin offerings, pushing the total to nearly $6.3 billion.

READ ALSO: NAFDAC gives update on Nido, Cerelac, other Nestle infant formulas alleged to have sugar in them

In regard to the Reserves backing fiat-denominated stablecoins, BDO further confirmed that Tether-issued tokens are backed by Cash and Cash Equivalents at an impressive 90%, underscoring its commitment to upholding liquidity within the stablecoin ecosystem. Additionally, in the first quarter alone, over $12.5 billion in USDt was issued.

The Reserves Report (RR) section of the new report reiterates Tether’s strong financial position.

The Management of the Company asserts the following as of 31 March 2024:

- The Reserves for Tether tokens in circulation amount to US$ 110,289,406,409.

- The liabilities of the Companies issuing Tether tokens amount to US$ 104,027,539,692 of which US$ 104,019,279,735 relates to digital tokens issued.

- The value of the assets composing the Reserves as of 31 March 2024, exceeds the value of the liabilities of the Companies issuing Tether tokens by USD 6,261,866,717.

The chart below shows a visualisation of the Reserves as of 31 March 2024.

The chart below shows the continued growth of US Treasuries and Cash and Cash Equivalents as a percentage of total outstanding Tether Tokens.

Tether Group’s strategic investments, totalling over $5 billion as of the report date, encompass various sectors such as AI and Data, Renewable Energy, P2P communication, and BTC Mining. These investments, while not detailed in the new report supporting the Fiat-denominated issued tokens, underscore Tether’s unwavering dedication to its mission.

“With the first attestation of 2024, Tether has demonstrated its unwavering commitment to transparency, stability, liquidity, and responsible risk management. As shown in this latest report, Tether continues to shatter records with a new profit benchmark of $4.52 billion, reflecting the company’s sheer financial strength and stability. In reporting not just the composition of our reserves, but now the Group’s net equity of $11.37 billion, Tether is again raising the bar in the cryptocurrency industry in the realms of transparency and trust,” said Paolo Ardoino, CEO of Tether.